-Introduction:

In the modern investment world, cryptocurrencies and Forex are two popular options that many investors are turning to. However, the question many ask is: which is more suitable for investors? Is it cryptocurrencies with their rapid gains and high risks, or the traditional Forex market with its long history and reliability? In this article, we will compare the two in terms of risks, opportunities, mechanisms of operation, and their suitability for different types of investors

-Mechanism of Operation and Regulatory Environment:

Forex:

Forex, or the foreign exchange market, is a market where national currencies are bought and sold. It is the largest financial market in the world in terms of trading volume, with daily trading exceeding 6 trillion dollars. Currencies are traded in pairs, such as EUR/USD or GBP/JPY, with each pair representing a comparison between two different currencies.

The Forex market is characterized by relative stability, as it is strictly regulated in many countries. Currency prices are determined based on local and international economic and political factors, such as interest rates, economic growth, and monetary policy conditions.

Cryptocurrencies:

Cryptocurrencies like Bitcoin and Ethereum are decentralized assets traded on blockchain networks using encryption technologies. These currencies are not tied to any central authority like governments or banks, making them more susceptible to sharp fluctuations. The cryptocurrency market is still in its growth phase and lacks the regulation seen in the Forex market, which may expose investors to legal risks and unexpected volatility.

-Market Nature:

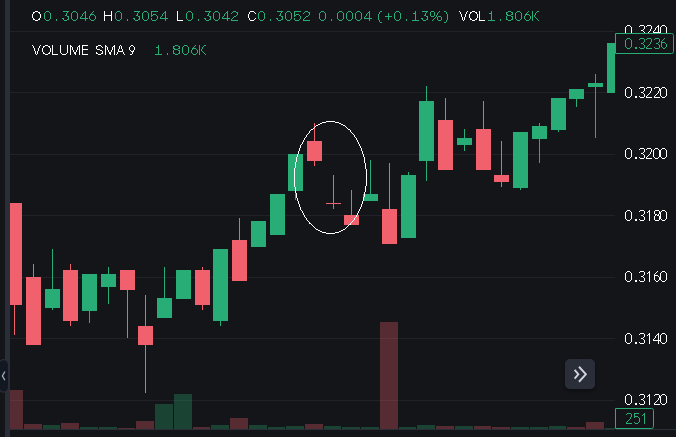

Cryptocurrencies: Cryptocurrencies are digital currencies that operate using blockchain technologies, allowing for decentralized value exchange without the need for intermediaries like banks. Popular cryptocurrencies like Bitcoin and Ethereum have gained more acceptance in the financial world and are considered tools for storage and investment. These currencies are characterized by high volatility, as their value can rise or fall dramatically in a very short period.

Forex: The Forex market is a market for trading foreign currencies between banks and investors, with currencies such as the US Dollar, Euro, and Japanese Yen being traded. This market is relatively stable compared to cryptocurrencies and is influenced by economic and political fluctuations around the world. However, despite its relative stability, the Forex market remains volatile during significant global events or changes in monetary policies.

-Volatility and Risks:

Cryptocurrencies: Cryptocurrencies are characterized by extremely high volatility. For example, the price of Bitcoin can drop or rise by 10% or more in a single day. This means there are significant opportunities for profit, but also substantial risks. Therefore, cryptocurrencies are considered riskier for investors who may not have the psychological or financial readiness to endure such fluctuations.

Forex: The Forex market, on the other hand, is less volatile than the cryptocurrency market. While there are fluctuations, the effects of economic and political events are generally more moderate compared to cryptocurrencies. Risk management in the Forex market is easier, with available strategies such as technical analysis and fundamental analysis

-Long-Term Investment vs. Short-Term Trading:

Cryptocurrencies: Cryptocurrencies present a good opportunity for long-term investment, especially in major currencies like Bitcoin, which has shown massive increases in value over the years. Many investors view cryptocurrencies as a store of value, separate from the traditional market fluctuations. However, these investments must be carefully considered due to the risks associated with government regulations and sharp volatility.

Forex: The Forex market is more suited for short-term trading. Trading in Forex heavily relies on monitoring currency price movements over short periods, with trades executed within minutes or hours. If you're an investor who prefers day trading or margin trading, Forex would be a better option, allowing you to take advantage of rapid market movements.

-Regulations and Legal Frameworks:

Cryptocurrencies: One of the main challenges of investing in cryptocurrencies is the lack of regulation in many countries, where there are no clear guidelines governing the trading and use of digital currencies. This can pose risks for investors in terms of security, fraud, or even sudden changes in laws.

Forex: The Forex market is more clearly regulated in many countries, where Forex companies are subject to strict oversight by financial authorities. In the event of any issues, there are investor protection systems in place. Additionally, regulatory bodies often ensure the security of funds in accounts.

-Opportunities and Profitability:

Cryptocurrencies: Cryptocurrencies offer highly profitable opportunities due to their large fluctuations, but these opportunities come with high risks. If you have the capacity to bear risks, you may achieve substantial profits by buying at low prices and selling at higher prices.

Forex: In Forex, opportunities are more stable, but profitability largely depends on trading strategies and market analysis. With various financial instruments such as CFDs, binary options, and technical analysis, investors can make informed trading decisions, providing consistent profit opportunities, though generally lower compared to cryptocurrencies

-Markets and Trading:

Cryptocurrencies: Cryptocurrencies can be traded 24/7, making them attractive to investors who prefer greater flexibility in trading times. They also support various types of investments, such as futures contracts and asset-backed tokens.

Forex: The Forex market operates only during official working days and closes over the weekends, limiting trading opportunities compared to cryptocurrencies. However, Forex remains the most liquid market in the world, thanks to the massive daily trading volume

-Conclusion:

If you're looking for significant profit opportunities and are able to handle high risks and large fluctuations, cryptocurrencies might be the right choice for you, especially if you're a long-term investor with a vision for technological innovation.

If you prefer stable investments and are looking for safer opportunities with the potential to achieve reasonable profits through calculated trading strategies, Forex would be the better option, especially if you're aiming to diversify your financial portfolio without exposure to unpredictable volatility